How does Cross-Sell Fit into Your Sustainable Growth Strategy?

Welcome back to our sustainable growth series! In our first installment, we discussed holistic growth and the three pillars of your sustainable growth engine. Then, we described how both acquisition and retention fit into a sustainable growth strategy. Now, we want to cover the last topic: cross-selling.

If your institution wants to achieve profitable growth, you need a cross-sell strategy that fuels your sustainable growth engine and can be maintained reliably over time. In this article, we are going to dive into the 3 ways to cultivate a cross-sell strategy that supports continuous growth, and some best practices to help you along the way.

Cross-Sell and Retention go Hand in Hand

Just like the other sustainable growth principles, cross-sell does not stand alone. There are clear connections between retention and cross-sell because ultimately, a cross-selling strategy is part of a retention strategy, too.

A successful retention strategy requires frequent contact, a consistent message, education, and trust – cross-sell does too! For example, you onboard customers in order to make a good first impression, then you can use cross-sell to continue to build the relationship and therefore retain them.

What are the Best Ways to Cross-Sell?

Cross-selling isn’t always easy, and still has some negative stigma around it. Cross-selling doesn’t have to be pushy or based on unattainable sales goals: being proactive about meeting customer needs as opposed to pushing the products you want to sell actually works and doesn’t hurt your brand image. Cross-sell during onboarding is a common tactic, but beyond that, financial institutions get two different opportunities to cross-sell. 1) when the customer reaches out to you (inbound) when they need something, and 2) when you reach out to them (outbound). These three cross-sell essentials will support your sustainable growth strategy.

1. Cross-Sell During Onboarding

It’s no secret that the goal of onboarding is to establish a relationship and lengthen customers’ lifetime value. Yet, some institutions don’t design an onboarding process that supports their cross-sell efforts. Some say around 75% of cross-selling happens in the first 90 days of the relationship. This leads us to wonder: do people stop buying banking products after 90 days, or do bankers stop trying to sell them? The reality is that customers don’t really buy that way – a customer’s financial needs change over time, not during a 90-day window! You must continue to cross-sell beyond those first 90 days, and throughout the entire customer relationship.

An ongoing, sustained process is designed to go beyond those initial interactions at account opening, or past those first 30, 60, 90-day windows. This way, you continuously engage with customers so cross-selling products that they actually need comes naturally.

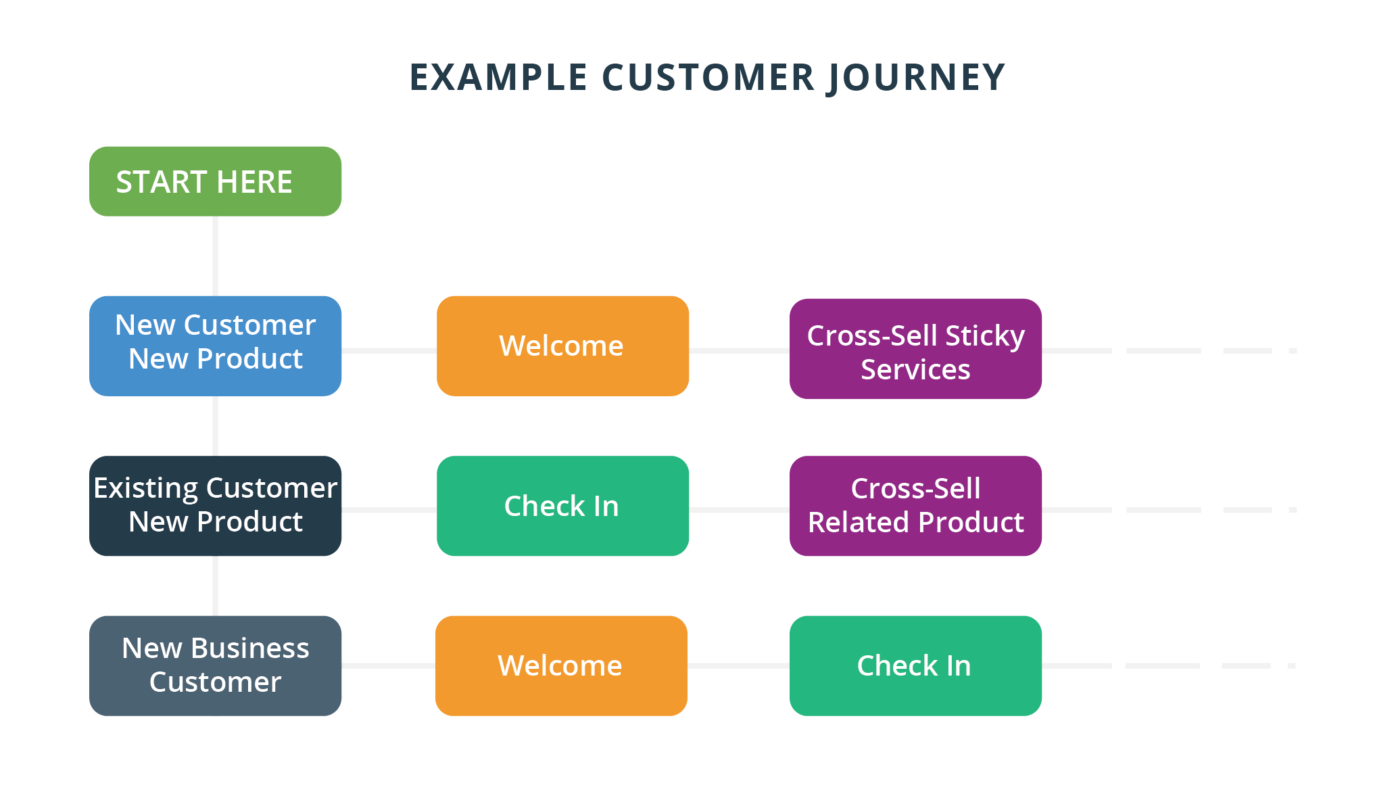

But where do you start? You can base this strategy on the customer journey. The customer journey is the path you guide the customer on throughout the relationship. The goal of following the customer journey is cultivating loyal, core deposit customers.

People are familiar with the checking account customer journey, but any banking relationship has its own path as well. The customer journey is dependent on what the customer buys and whether they’re a new customer or an existing customer. For example, if a new customer opens a new account, their customer journey will be entirely different from an existing customer who opens an additional account. Their starting points are different, so their onboarding process and customer journey will look totally different. Similarly, the way you engage them with their new product will be different as well.

Financial institutions try to push sticky services around checking accounts to make it harder for customers to leave. There’s nothing wrong with sticky services, but that’s not the customer’s entire journey. You won’t grow any relationships by solely offering sticky services in the first 90 days of the relationship and neglecting to contact the customer after that. That’s why your onboarding process needs to set up and facilitate future cross-sell opportunities.

Remember: Onboard more than checking accounts

A lot of effort goes into onboarding new checking accounts, but many institutions don’t even onboard their other products! By doing this, you are choosing to ignore the rest of your customers, and all the opportunities that lie within. This is no way to foster a loyal and long-lasting relationship.

Rather than inundating new customers with product offers in the first 90 days of the relationship, financial institutions need to consider an ongoing onboarding strategy that will lead to long-term cross-sell success and customer retention.

2. Inbound Cross-Sell

Inbound cross-sell is the process of offering products and services when a customer reaches out to you. Customers continuously experience lifestyle changes: they’re graduating from college, getting married, having children, buying or selling homes. How can you identify these lifestyle changes at the right time so your institution can offer relevant products and services to meet their changing needs? To do this well, you need to know which products they already have (thus avoiding irrelevant offers) and what has previously been marketed to them. Whatever their reason for reaching out, be prepared to have a relevant and well-informed conversation that offers value to them. Sometimes, that means simply helping solve their problems. Other times you can offer value by selling them a product or service.

3. Outbound Cross-Sell

Outbound cross-sell is about directly reaching out to customers to help meet their financial needs, instead of waiting for them to come to you. The best way to do this is by leveraging customer data to understand their needs. This results in better conversions and better conversations.

We have seen that many financial institutions have a large group of customers that no one has reached out to in years. This is because their institution doesn’t continue to offer relevant products or services after the start of the relationship. It’s vital to set up frequent outbound communications to keep your brand in front of them. Then, they will think of you first when they need something.

Additionally, ongoing, two-way communication with your customers provides your bank with important feedback so it can consistently send timely relevant offers to your customers based on their life stage and needs. By learning what your customers want and need, you can consistently provide appropriate offers.

Automation Supports Ongoing Cross-Sell

Each of these cross-sell opportunities can be improved by automation. Automation uses technology to execute certain tasks, which helps maintain consistency and efficiency while saving valuable time for your employees. Automation augments tasks for bankers by facilitating conversations and helping to manage other relationship-building activities.

Everyone knows that onboarding needs to be automated, but you can automate cross-sell as well. The goal of automation is to leverage data and technology to create a systemic marketing process, meant to be continuous and executed daily to achieve real results. Systemic marketing avoids one of the most common pitfalls: starting from scratch every time.

Automating some of your cross-sell activities makes outbound relationship programs part of your daily routine, helps you to balance between multiple channels, and continuously fuels your sustainable growth engine.

Cross-Sell Best Practices

-

Map out customer journeys – By mapping out the different customer journeys, you know where you’re starting and what actions you need to take to further the relationship all along the way. But remember to start simple – you don’t have to map out every possibility for every kind of customer. As you can see in this graphic, the point of this practice is to give you an idea of the next steps at each different part of the customer’s journey with your institution and to remind us that relationship building is an ongoing process.

-

Segment based on life stage – Many institutions use age and income as their go-to demographics. These are important factors, but they don’t tell the whole story. Segmenting based on life stage takes into account all sorts of information like marital status, households, and more. It’s a data-driven approach to knowing which products or services customers have the highest propensity to want. If you don’t have this data that goes beyond basic demographics, you need it to truly understand the customer! Luckily, there are fintech companies that can gather this important information for you. Once you can clearly see these things about a customer, you can better understand their unique needs and subsequently can offer the most relevant products and services.

- Predict financial needs with data analytics – One of the keys to successful cross-selling is identifying which banking products customers have a high probability to need with advanced analytics. Some systems can make predictions of what customers may need next based on the products and services they currently have, as well as based on their life stage as we mentioned above.

Because customers don’t purchase products and services in a perfect sequence, taking a “needs-based” approach will produce outstanding conversions and will increase satisfaction. Plus, you avoid the irrelevant offers that hurt your brand reputation – no one likes getting those offers!

But remember: Cross-selling is more than just slicing and dicing data to try to reveal some hidden need for the bank’s products and services. Cross-selling should be grounded in relationships. By communicating consistently with customers, you’ll build trust, and they’ll know they can come to you for financial advice.

- Unite marketing and retail – A very common problem in cross-selling is a lack of collaboration and communication between customer-facing employees and marketing. The last thing you want is a customer to walk into a branch to open a new offer-based account and branch employees have never heard about the promotion! Marketing activities should be part of your greater understanding of the customer, and this needs to be accessible and universally understood. This way, everyone across the institution can provide relevant offers every time. When a customer talks to a banker, they should be able to see all communications the customer previously received. If everyone is on the same page, customers will always get a consistent, streamlined, and personalized experience.

Reliable, Sustainable Growth

Continuous cross-sell is a necessity in driving sustainable growth. In addition to cross-selling during onboarding, take advantage of inbound and outbound cross-sell opportunities. You can’t afford to miss the opportunity to build trust-based relationships with your customers. Focus on developing a data-driven cross-sell strategy that identifies and meets the personal needs of your customers.

Something sustainable can be maintained over time. While the COVID-19 pandemic accelerated growth for many institutions, what worked last year won’t work anymore. Managing and excelling at acquisition, retention, and expanding relationships through cross-sell will help you build a growth engine that stands the test of time.

While these objectives are difficult to execute, they all work together. You must first find the right kind of new customers that are less likely to leave. Then, use onboarding to improve these customers’ experiences and reduce attrition. Further, cross-selling to them leads to deeper relationships and lower attrition. This holistic and interconnected approach to growth works because none of these pillars can stand alone. Everything you do to acquire, retain, and grow must be tied together to support your overall sustainable growth strategy from start to finish. It’s time to get started on your sustainable growth plan to secure future success – or get left behind in 2020.

Thanks for tuning into our sustainable growth series! Now you are armed with some actionable approaches to lasting growth through acquisition, retention, and cross-sell.

Ready to achieve sustainable growth? Request a demo!

Like this post? Don’t forget to share!