What if we told you data is the key to everything? Learn how to harness it to improve relationships, grow, and overcome your data dilemma.

Did you know that your data is the most strategic asset your financial institution has? Banks and credit unions hold such personal data about their customers – more than any other industry. Yet, it remains such a struggle to access it, understand it, or know what to do with it. At the end of the day, understanding your data is the cornerstone to growth. In this article we want to show you how to start better utilizing your data to improve marketing, business development, and ultimately turn it into better customer relationships.

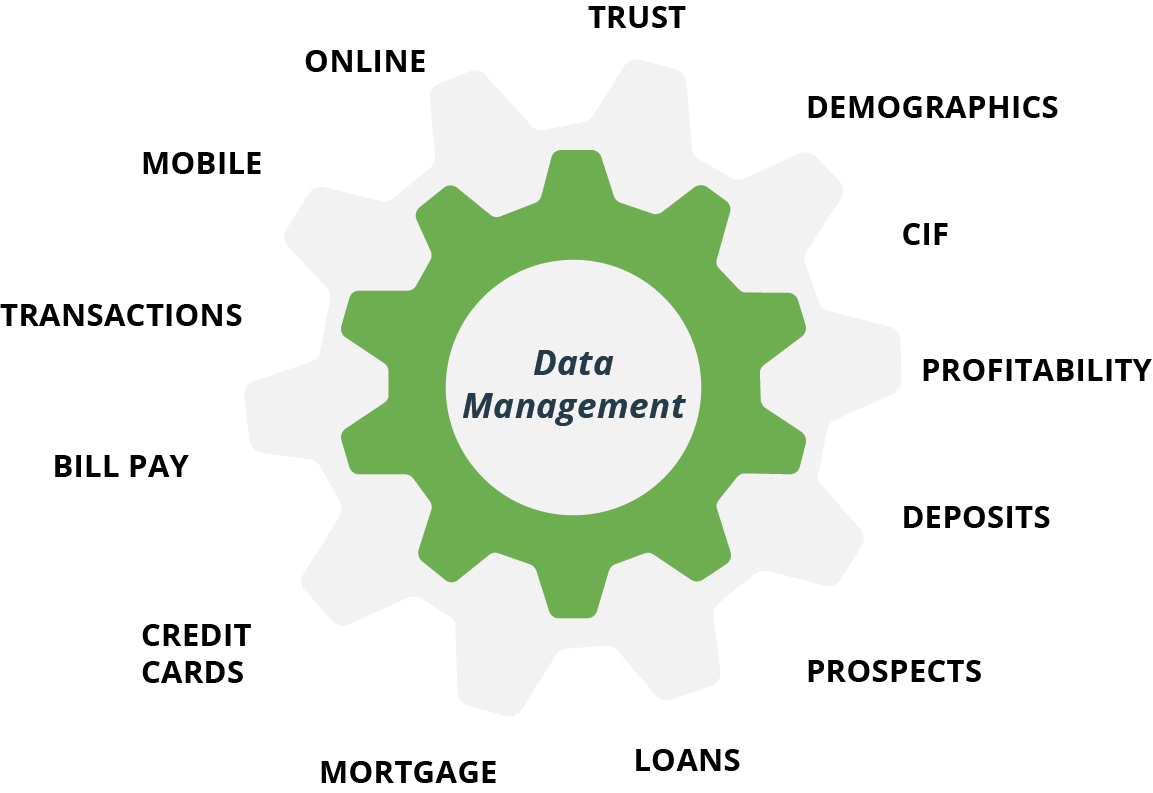

Financial institutions store millions of data elements across their many systems that detail everything they need to know about their customers, but often cannot see all of it work together. They can have up to 20 information silos – each full of underutilized and inaccessible data. These applications do their job well, but that doesn’t mean you can assemble a complete picture from your data.

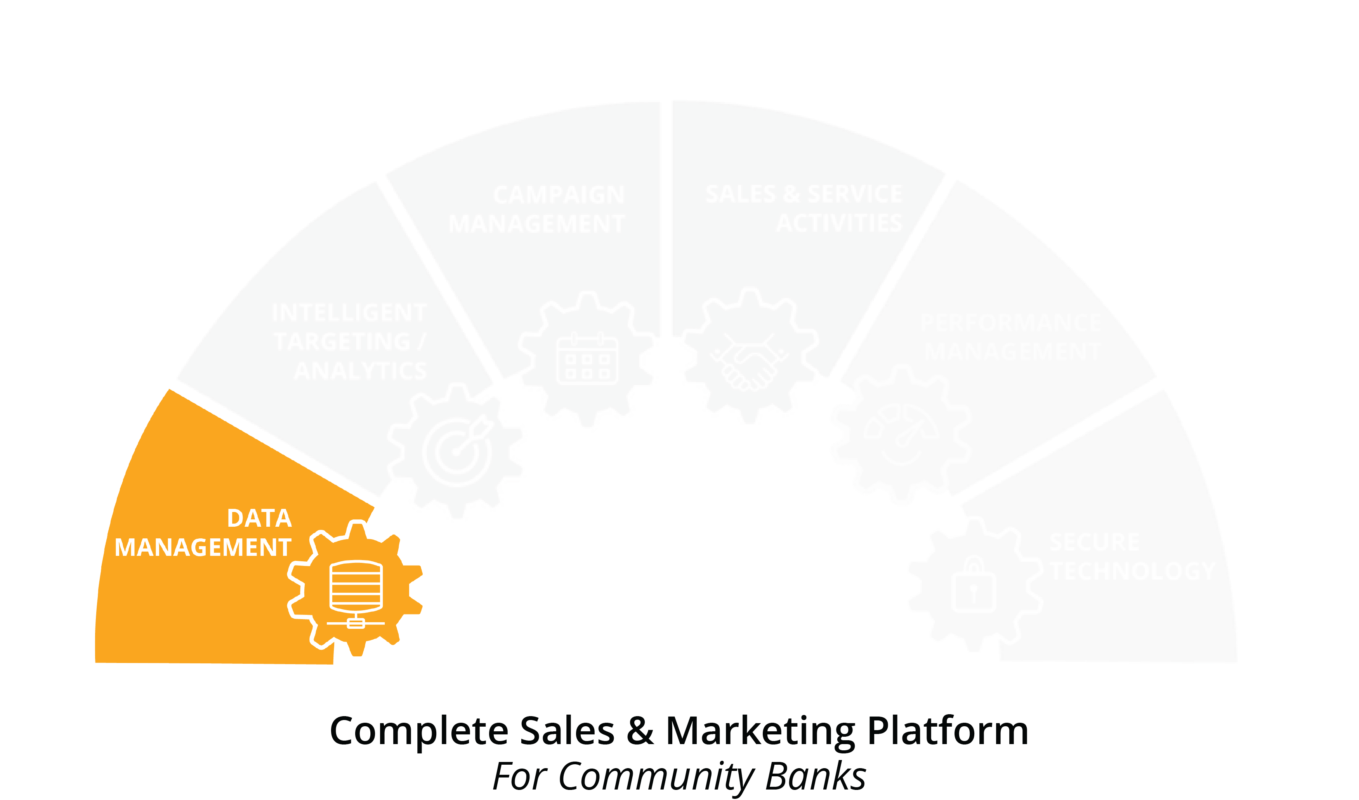

Data management and integration is just a single piece of a large, complex puzzle. This article is the first in a series detailing what financial institutions need in order to grow efficiently and sustainably. Throughout the series we will talk about the main growth barriers that financial institutions face and the best ways to tackle them.

Your Problem: The Data Dilemma

Data is messy. It can be incorrect or inconsistent, affecting the way your institution makes decisions. This is largely due to manual data entry, which leaves a lot of room for erroneous or duplicate information. Data is truly a moving target – people change their addresses, phone numbers, marry, divorce and so on, and they often forget to tell their bank. How can you stay on top of it when dealing with:

4,071 new addresses added to USPS daily

121,452 address changes daily

Only 33% current, correct, deliverable email addresses

Data decay rate of up to 3.4% each month

USPS

We call this the data dilemma because banks and credit unions need access to their data and the insights that come with it, but sometimes they just don’t know how to get to it and how to make it understandable. How does the data dilemma impair your growth and goals? There are three well-known strategies that financial institutions use to grow deposits that are obstructed because of their data visibility and quality:

- Acquiring the right deposit customers – you don’t know who the right customers will be if you don’t know what your best current customers are.

- Retaining valuable deposit customers – how do you retain customers when you cant see the full picture of the relationship?

- Improving and growing relationships – how can you deepen the relationship if you don’t even know all the products a customer has?

The data dilemma doesn’t have to be your reality. What you’ve always done doesn’t have to be set in stone. Luckily there are alternatives to managing your huge amounts of data and ways to make your data actionable. Because the disparate information stored by your institution is so valuable, it’s time for you to harness this data once and for all and make it yours.

What Exactly is Data Management?

Sometimes it’s hard to see your data working together because the different systems only tell single parts of the whole story – you have to integrate each of them together to see how they interact. Integrating the data connects each piece of information to create the big picture. This integrated data then gives you the insights about your customers and the health of your institution. The 3 main requirements of properly managed data are:

- Clean data – Parse through duplicates, manual entry errors, and incorrect information, and validate correct information

- Integrated data – Match information across all sources

- Enhanced data – Increase the value of data with third party information

READ MORE ABOUT DATA INSIGHTS:

Make Your Data Insights Actionable with Smart Campaigns

Community Financial Institutions Have a Special Place in the Market

– they’re in the hometowns and main streets and can foster deeper, more personal relationships. When you harness your data, you can further enhance these special relationships with your customers. Properly managed data helps you know what they need and when they need it and allows you to be a better advisor to them.

Banks and credit unions can leverage their information and turn it into actionable and insightful campaigns. But, you need to be sure that your marketing efforts are smart, not instinctual. Some institutions are guilty of sending inappropriate offers simply because they aren’t sure which products their customers have. When you aren’t aware of the information you have stored away, you end up sending an offer for a product a customer already has. These offers are just shots in the dark. Customers can get this hands-off experience elsewhere, so community institutions need to hold tightly to this key differentiator.

Knowing Your Customer

Your most complex relationships are often the most valuable, but they are also the hardest to understand. And relationships between different pieces of data may only become apparent when aggregated. Again, the ability to zoom out and see the big picture is an incredible advantage.

If you plan to compete with the big guys, knowing the customer is crucial. You need to be able to target the right customers and offer the right products at the right time. When your customers actually need what you’re offering, trust is built and needs are actually met. Using your data to understand what these customers want can put you in front of them and creates better opportunities to market to them – you may even know what they want before they do! The big banks are spending millions of dollars on software to understand their customers – but community banks don’t have the same resources to buy advanced technologies from multiple vendors and gain these same insights.

Often, financial institutions use intuition-based approach to offer products to their customers. They may think that since an individual is a certain age they need a certain product – a person’s age is only part of the story! The fact of the matter is this: human beings are inherently complex and every customer is different. Simple demographics (Age, gender, etc) cannot tell you everything you need to know. Unfortunately, when financial institutions can’t see all their data, they are unable to really know which products a specific customer may need. This causes frustration and distrust among customers. Being able to see and learn from customer data gives you the opportunity to be exactly what the customer needs when they need it. Be there in front of them before a challenger bank or a big bank can.

What are you Doing to Make your Data Count?

Despite your data dilemma, we can solve problems in a painless way. What you need is a tool to place on top of your core that has the ability to show you everything you need to know about your customers.

Don’t be scared to tackle this problem! There are solutions that tackle it for you. We know its lots of work to get there and can seem expensive. But as data becomes increasingly valuable, you can’t afford to stay this way. Luckily, a strategic partnership can effectively and affordably build on top of your core to show you exactly what you’ve been missing – at prices a community institution can afford. Realizing this is just the first step to getting it all in one place.

Like this post? Don’t forget to share!