Don’t know where to start? Contact us!

Many industries are providing unforgettable experiences for their customers. Consumers have become accustomed to high-touch communications from the big brands they trust. Customers have always wanted friendly, efficient and reliable customer service, but new technology has raised their expectations even higher.

While these expectations have evolved, most community financial institutions lag behind bigger companies. Many have invested in new digital applications but not in modern marketing technology. We believe that financial institutions are held back because of outdated marketing systems, like MCIFs, that keep you from providing better customer experiences.

Now is the time to leverage modern marketing technology to improve your customer’s experiences with your brand. This will allow you to automate your marketing like Amazon and Netflix while retaining your biggest advantage: your personal customer relationships!

Modern marketing in financial services requires modern technology AND modern strategies. This article outlines 7 key steps you can take to improve and automate your communications.

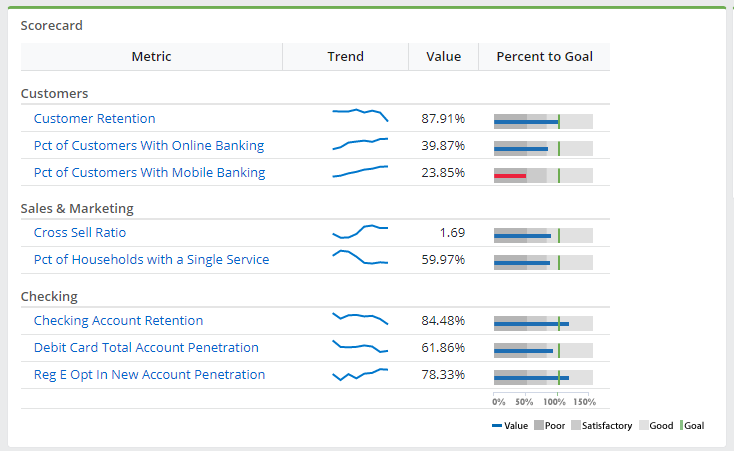

Peter Drucker, an influential thinker on management, once said, “If you can’t measure it, you can’t improve it.” While this seems obvious, it is difficult to implement measurement programs that can tell you where you are every day. Some measurements that are pertinent at an executive level are less meaningful to the marketing team and to front-line staff.

Yet, if you want to improve your institution’s performance, you have to see measurements that show where you are before you know if you are improving. To improve your marketing, your institution must start with a concrete idea of where positive change needs to occur, and your current metrics are the first place to start.

For example, your community institution might determine that you need to see an increase in mobile banking usage or checking retention. By knowing that at the beginning, you will be able to measure how renovating your marketing has directly impacted mobile banking or checking retention.

Scorecard

Many institutions have implemented scorecards to measure, monitor and manage progress toward achieving goals. Scorecards are a fast and easy way to look at important metrics and communicate strategic objectives to your whole team. Your financial institution may have scorecards, but they may not be automated or go into much detail. Advances in data analytics allow for your institution to create accurate and automated scorecards.

Tips:

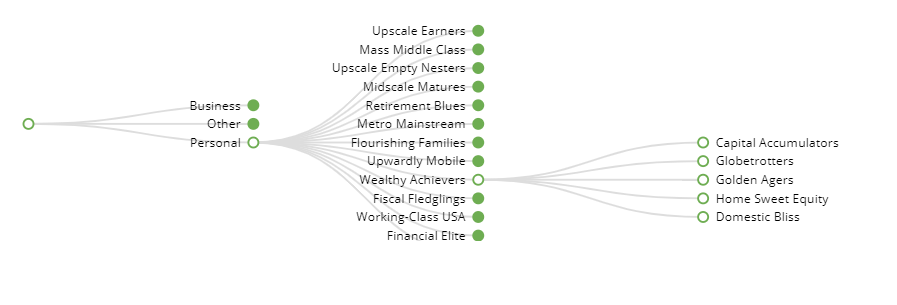

Segmentation has been a mainstay of financial marketing for many years, and it is still very useful today. Generally, segmentation is thought of as breaking customers into like groups based on demographics, but there is really no such thing as a single segmentation system for all purposes. Some institutions use simple age and income schemes while others use 3rd-party systems.

1 Example of Demographic Segmentation

These demographic-based approaches are still very useful to understand retail segments and their financial behavior, including product needs, while simple segmentation (person vs business, new customer vs existing customer) helps with communications programs like onboarding.

Tips:

Segmentation is still a requirement for modern marketing, but there are better approaches to determining customer needs! The human brain can understand a simple segmentation model, but it is much more difficult to understand multiple data points to evaluate customer behavior.

Today, your institution has dozens of systems that contain customer data, and that data has enormous value. You now have hundreds of data points for each customer that can be used to predict their needs. You need to be able to make use of artificial intelligence to leverage this data to know how to target the right offers to the right customers at the right time. We call this “intelligent targeting”.

Intelligent targeting is a data-driven process that requires high-quality data that has been integrated, cleaned and enhanced. It uses math and statistics to analyze the patterns of what your customers are buying and not buying and then uses those patterns to predict what other customers need.

Capital One, Amazon and Netflix are just a few examples of companies that anticipate their customers’ needs by using this approach. Fortunately, today’s marketing platforms are equipped with the technology to implement intelligent targeting for your institution.

Tips:

Many financial institutions are limited in what they can do because they do not have marketing automation in place. This leads to occasional marketing campaigns that are often based on your needs rather than your customers. Your institution must continuously reach out to engage your customers to improve their experience and to increase the value you provide.

By moving to a continuous marketing approach, you can minimize the effort you put into manual programs and maximize what you can automate. Modern marketing systems, like FI Works, implement automation throughout to create marketing processes that work every day. Daily updates and built-in email capabilities avoid the need to continuously import data into dated email systems. You can also use automation to distribute tasks to your front-line staff. Some even have built in CRM features to truly connect marketing and sales.

Tips:

Community financial institutions have a strong advantage over your larger competitors because of your personal relationships with your customers. Automation allows you to send out messages in a timely manner, but don’t forget to personalize your messages to keep this advantage! Use your data and customer segmentation to make the message more personal.

Personalization isn’t always about customizing automated communications. Large institutions almost exclusively use automation and forgo the connections made when accounts are opened. Today’s marketing platforms allow you to mix automated messages and personal phone calls to leverage your community advantage.

Tips:

You get one chance to make a good impression – that one chance starts with onboarding. Onboarding begins the customer’s journey with your institution. The building of trusted and long-lasting relationships starts here.

Most institutions know that they need to onboard, but many are not doing it. Why? The roadblock to onboarding is the fact that most institutions lack the ability to automate onboarding tasks, and it can be hard to track whether the tasks are being completed. If all you have is an older MCIF with limited channels (print, list, exports), it is virtually impossible to do consistent onboarding.

With automation, you can excel at onboarding by communicating with your customers and tracking how and when an employee is reaching out to a customer.

The best onboarding programs differentiate between new customers and existing customers with new accounts. You need to be able to segment your customers accordingly. There is a big difference between a welcome message and a thank you message! Don’t be guilty of treating a long-term customer like a new one. Segmentation should also be used to have different messages for personal and business customers.

Cross-selling

Yes, we know…cross-selling can get a bad rap. What if we told you that you can successfully incorporate cross-selling into your onboarding program? Instead of focusing on what you want to sell, focus on what your customers need. By analyzing your customers before calling them, you can be prepared with products and services that they may genuinely be interested in based on what they currently have. Intelligent targeting enhances cross-selling by providing recommendations to your front-line staff.

Tips:

Onboarding is the right step to take in the beginning of your customer relationships, but do not let the communication stop when the process of onboarding stops. Your customers have not gone anywhere yet, but they may if you don’t continue building the relationship. Think about when you connect with your existing customers. When they visit a branch? When they have a problem? When you want to sell something?

You need to continue to nurture these relationships year-after-year. Nurturing focuses on communicating with your existing customers using a similar approach to onboarding. Instead of using the account open date to trigger communications, you can use the customer’s anniversary date.

As with onboarding, you can use segmentation to determine the cadence of communications. For example, if you have a deposit customer with more than $1m, how often should you check in on them?

Surveys

Do you want to know what your customers are thinking and what they need? Well, ask them! Surveys are the perfect opportunity for you to ask questions and communicate during the nurturing stage! Utilizing surveys can help you better understand your customers and what they need.

There are a couple of different surveys that can help you learn more about your customers. First, a quality survey can give you the information about how they feel about you. Whether you’re using a net promoter score approach or something more detailed, surveys are an easy way to gauge customer satisfaction.

You can also use surveys to get your customers to tell you what they need from you. These are often called “needs assessment” surveys. Response rates on needs assessment surveys can be low, but the customers that answer will have specific needs.

Cross-selling

People often say that the majority of cross sales happen in the first year of a relationship. But is this because customers buy that way or is it because you stop trying? As with onboarding, you can use intelligent targeting to provide valuable product recommendations to your existing customers. This leads to stronger and more profitable relationships.

Tips:

The best automation and technology in the world won’t matter if your programs are not producing results. It’s now time to ask the hard questions:

Tips:

With all the discussion around automated, continuous marketing programs, you might think that we don’t value intermittent marketing efforts. There will always be a need for specific campaigns to achieve specific goals. The great thing is that you can leverage the same techniques (segmentation, intelligent targeting, personalization) to make these efforts more successful. Marketing automation will make it easier to set up and execute these campaigns.

An updated marketing system, like FI Works, can equip you with ways to maximize your marketing efforts. Data analytics and automation work together to help your institution give customers the best experiences to drive deeper relationships while retaining your biggest advantage as a community institution.

You are now aware of how an updated marketing system can benefit your financial institution, so what are you waiting for? If your financial institution wants to see real results, it’s time to implement these key concepts and let go of outdated marketing.

With traditional marketing software vendors fading out, now is the time for your community institution to try something new. Contact us to learn how FI Works can help you update your marketing system!