In today’s competitive environment, it’s important for banks to maintain and grow customer relationships in order to sustain profitable growth. But as banks continue to attract new customers through acquisition, existing customer churn undermines this growth.

“Churn” refers to both the percentage of customers who end their relation with a bank and customers who still use a bank’s services but not as much or as often as they used to. One of the biggest reasons for churn: Customers’ needs change — often without the bank anticipating or even noticing these changes.

If banks want to prevent churn before it happens, they need to do a better job of anticipating and understanding their customers’ needs. Unfortunately, banks don’t have a crystal ball to help them predict customer churn. However, they have something almost as good: transactional data.

Data, such as the number of ACH transactions, debit card usage and number of checks written, provide banks with a rich repository of information. Data mining and analytics break down customer information to drive insights that can help identify “at-risk” customers. This proactive identification of at-risk customers combined with targeted communication can significantly reduce customer churn.

When deciding what customers to keep or grow, banks need to consider the entire banking relationship. Analytics offer a 360-degree view of customer lifetime value, so educated decisions can be made about which customer relationships are worth salvaging.

Using analytics to segment the customer base and track the history of account transactions, banks can build models to predict the likelihood of customer churn. These models rank customers on their likelihood to attrite. With that knowledge, a bank can market specifically to customers with qualifying attrition scores.

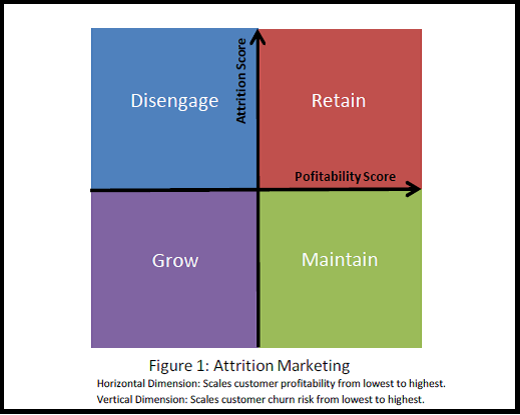

When you calculate customer attrition scores with household profitability, your bank can segment its customer into four attrition marketing quadrants (Figure 1). Customers in the upper-right quadrant are profitable, but likely to leave. They should be given marketing priority. Customers in the lower-right grid are profitable with a lower attrition risk. These customers should be managed with effective customer service, but warrant less retention messaging. In the upper-left grid are customers who are less profitable and likely to attrite — and not a target for marketing resources. The bank would be better served redirecting its efforts to the lower-left quadrant to customers who are less profitable and less likely to attrite. These customers should be actively cross-sold to deepen their relationship with your bank.

Banks historically have focused their retention efforts on customers who leave. However, the greatest area of opportunity may be with customers who have significantly reduced their balance relationships and who have moved their savings and investments to other financial institutions. These look like retained customers, but this group doesn’t add profit to the bank. Remember, not all customers are worth saving. Just like it doesn’t make economic sense to approve every loan, it also isn’t financially smart to retain every customer.

Being able to predict when customers may jump ship or identify those who use the bank’s services less often can help banks take pre-emptive measures to retain and grow these customer relationships. While banks can’t see the future or read customers’ minds, they can use analytic tools to minimize customer defection and grow existing customer relationships.