Planning on an all-digital marketing strategy for the new year? Don’t forget your other channels: Ultimate marketing success in 2020 leverages a multichannel approach.

Financial institutions have been integrating new channels of digital marketing into their repertoire steadily for the past decade (and then some). Some have incorporated them beautifully while others struggle to keep up with the changing trends. There has been confusion about what constitutes as digital marketing, and many financial institutions feel — incorrectly — as though digital marketing is simply sending marketing emails or having a social media account. Realistically, digital marketing can include both of these, as well as text messaging, online surveys, and digital advertising (plus everything that can entail). The emergence of these methods and their new mediums are very exciting, overwhelming, and continue to be the shiny new thing. But today we want to advise you that traditional marketing methods are not disappearing anytime soon, even in the ever-developing digital era.

Before you forget about traditional marketing methods altogether, remember that direct mail, personal email, phone calls, and event marketing are still very important. Digital is essential to your strategy, but it’s certainly not the only way. One of your goals as a financial institution should be to make seamless experiences a reality for your customers, and sometimes that means not confining your communications to digital-only. The good news is that you don’t have to LIMIT your marketing to just one kind.

The Digital-Only Mindset

Financial institutions tend to be distracted by digital-everything mindsets. While digital is certainly an effective tool, in some cases it doesn’t reach everyone — you can’t ignore the customers that don’t participate digitally. Everyone stresses digital (and we certainly do, too) but let’s not leave behind traditional channels. We have seen firsthand how the intermixing of your channels can improve your customer’s experience, boost sales and in turn, help financial institutions grow. In this article, we will explain the benefits of mixing your digital and traditional marketing methods in order to create a sustainable marketing strategy for the new year that creates the experience a modern customer requires.

What Marketing Looks Like in the New Year

The sheer number of options banks and credit unions have can prove overwhelming because consumers can be reached through so many different mediums. Therefore, each different kind of marketing must be thoughtfully considered in the many unique situations that arise. This is called multichannel (or omnichannel) marketing.

In 2020, multichannel marketing will continue to expand, and may even present itself in new forms. Because of the exceptional customer experience provided by well-loved companies (think Amazon, Google, and Apple) customers expect a certain level of interaction with brands — and this includes their bank or credit union! Now you can reach qualified customers that you may never have found before. Through multichannel marketing, customers become familiar with your institution while you build loyalty and earn their trust.

Targeting is a Requirement in Modern Marketing

If you don’t read anything else in this article read this. It saves your time and money by helping choose the right candidates to market to. Keep in mind that you should only be sending or targeting your ideal customer, not every single person in town. Many institutions’ targeting is intuition-based, but this is not the best approach. For example, basing campaigns on segments like generational group or income group is an outdated approach.

Some still use a saturation method like selecting zip codes, but you’ll always end up spending more than you should. You’ll create higher numbers of potential contacts, but they will be less qualified leads. Ultimately, saturation campaigns end up costing you for lower response rates.

This leads us to ask, how do you find these ideal customers? Intelligent (data-driven) targeting is the key. Data-driven targeting is the best way to narrow down who receives your marketing, discover the most qualified prospects, and stand out to those who are most actually want to buy your products.

Click here to learn more about how intelligent targeting works.

Getting into Multichannel

It’s tempting to use just one channel for one campaign, instead of using multiple channels to better reach the customer. Using a one-and-done strategy can waste a lot of time without a targeting plan. Using one channel for one offer for one customer, or even mailing/emailing someone a single time reduces your chance of a response. Some forms of marketing are more effective than others in different situations. Therefore, a multichannel approach can help you see which channels work best and how they can work together. Multichannel doesn’t mean asking “which channel should I use for x?” — It means taking a step back and asking which are the best channels for a specific campaign, offer, or situation. You can even choose to employ all of them, if you know that it will work for a given campaign. Be sure to use different channels together as multipliers of your overall marketing strategy. Your multiple channels should be working as a team toward your goals.

Leveraging Digital Channels

Digital ads can make a huge difference, but don’t jump right in before digital onboarding is in place. Different pieces of the onboarding process deserve to be made digital, and the combination of channels will create a seamless experience for you and your customers.

The customer should be able to expect your presence from the beginning: after clicking on an ad, starting an account or buying a new product. It is so important to make this presence appropriate for the buyer’s journey — don’t overdo it by bombarding them with conflicting marketing messages.

Email, text messaging, online surveys, digital ads, automation, and social media (presence + targeting) are all vital to a modern marketing strategy. Learning how to make these relevant and interesting to consumers is the tricky part. How do the different channels interact with each other? How can they compliment each other? How do they relate to the customer? For example, if a consumer is scrolling on social media and they see a targeted ad for your financial institution, then later see a billboard or print ad, their awareness has been raised. Then when they are looking for a product you have, they are more likely think of you. These two channels complimented each other.

Roadblocks to your Digital Marketing

Many institutions deal with a data dilemma that hinders their ability to employ digital channels with their own customers. Customer information is often in multiple systems with conflicting values that aren’t always easily accessible. When a customer opens an account they give their email address, but when they change it they don’t always let you know. Even if they change it through a digital channel like mobile banking, it still doesn’t mean it’s updated in the core system. Now you have multiple email addresses in different locations for a single customer.

Email marketing can generate a return, but not if they don’t even see your email. One of our studies revealed that only 45% of a typical bank’s customers have email addresses on file. From there, we found that 12% of these addresses were undeliverable, which can leave you with valid email addresses of around 33%. Then consider that 20% of people in the US change their email addresses every year (USPS). This 33% roadblock hinders you from sending digital marketing messages. It makes analyzing your return, understanding customer feedback, and even offering new products that much more difficult.

Digital Marketing to Prospects

Whatever you do, don’t make the mistake of buying email lists to market to. To be clear: You cannot buy an email list and call that digital marketing — this is against privacy law. Don’t waste your money on lists of people that will be frustrated by receiving emails they never signed up for — you’ll get blocked and reported! Earn trust through traditional methods of marketing and through stellar customer service, then gain email addresses organically through their interest.

Although you can’t market to prospective customers through email, you can still reach them through other channels. There are digital channels like search/display advertising (on the internet or social media) and there are traditional ads. Paid search ads can show up on a prospect’s browser and are often targeted through geographic location. These are usually purchased through Google, Facebook, and other social media platforms that your prospects use — but it’s still not a catch-all. Note that the harm in this situation is that only targeting through location can result in sending inappropriate offers (like a Money Market offer to someone who already has one) and breaking the trust of a potential customer before you even start. Plus, you cannot account for customers who do not participate digitally. This is precisely why multiple channels are required to reach different kinds of customers.

Social Media

Social media can be two things for you: a place to connect with customers and a platform for advertising. Social media is especially great for building rapport with potential and current customers, and as a way to target ads to potential customers. We want to emphasize that although modern marketing practices almost always suggest social media advertising, it may not be the most appropriate choice for certain offers and products each time. Always think about the context of the product and the prospect to whom you are advertising.

Leveraging Traditional Channels

Direct Mail, personal phone calls, personal emails, and event marketing make up the traditional methods that should still be considered in the new year.

When customers are inundated with digital advertisements, a more direct method can grab their attention — but it needs to stand out to them! Personal phone calls and emails can still be effective marketing channels if you have the ability to target communications. Sending a targeted email about a specific product and following-up with a personal phone call adds a considerate touch. If you target well, you’ll successfully deliver offers that are relevant to the customer.

Personal contacts are so valuable. You’ve already earned their trust if you have their contact information. Depending on what you want to communicate, the best channel could still be a phone call. If you want to contact them about something of importance or something private in real time, personal communication through phone call or email is much more suitable for the situation.

The Case for Direct Mail

Do you assume no one reads direct mail advertising anymore? Think again. Direct mail is one of the only ways to reach non-digital consumers. Why do you still get credit card offers from Capital One and American Express? Because it still works.

The best way to take advantage of mailers and other print is to use intelligent targeting to cultivate who you market to deliver a more intentional message, thus saving you from irrelevant offers.

Other Helpful Tips

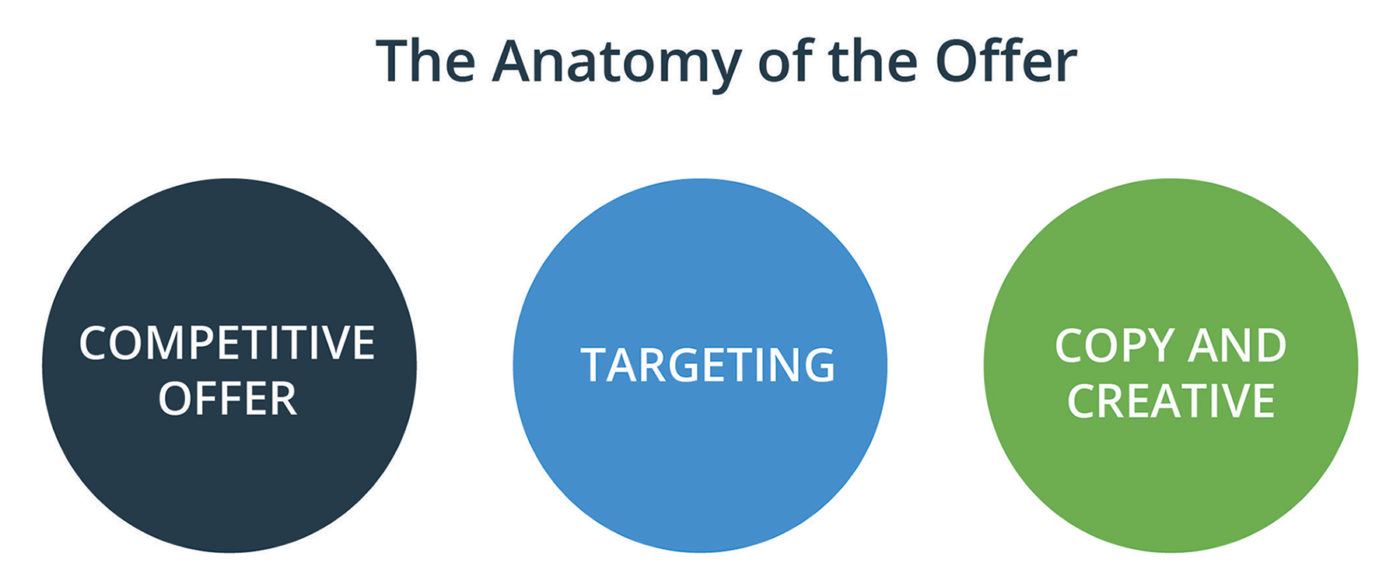

- Consider all the parts of the offer

There are three important aspects to think about for every campaign you conduct. First and foremost is the targeting. A targeted offer is only sent to qualified leads. Next is excellent copy and creative that needs to be well-designed and motivates the prospect to take a second look. But, design only goes so far. Finally, the offer itself must spur action! It needs to be competitive to get a solid response — are you offering them anything of extra value in the first place? These three aspects, if executed well, can make any campaign worthwhile.

2. Avoid over-saturation

The average American household receives 454 pieces of marketing mail a year (USPS) and Americans are exposed to between 4-10,000 ads each day. (Forbes) How do yours stand out?

When it comes to multichannel marketing, don’t overdo it.

3. Follow-Through

Follow ups foster a better response while building on relationships and legitimacy. Examples in the credit card industry shows a noticeable lift in response rate when there are multiple mailers about the same offer. Multiple mailers are a follow-through tactic that can really raise awareness for your brand or the specific product you want to sell.

Follow through on your campaigns to see the results from your efforts, but be able to track the response rate or return rate — these are two very different things. A campaign one of our clients conducted exemplifies this: A targeted offer was sent out to 26,000 people, and even though the response rate was low, the total amount of new deposits was significant. This concluded in an exceptional return rate, but an abysmal response rate.

4. Have a Clear Purpose

Finally, we urge you to know the purpose behind each kind of advertising and marketing you conduct. Ask yourself these questions:

-

- “Why are we sending them mail/email/calls/ads when they already receive lots of it?”

- “Is our call-to-action clear and easy?”

- “Is there much incentive to act?”

Ready to take the next step and boost your marketing?

Like this post? Don’t forget to share!